donation exemption for income tax malaysia

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 2811 Section 101 of the Income Tax Act Cap.

Let S Upgrade Your Charity Dashboard You Can Now Easily Issue Tax Receipts

To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

. The Malaysian income tax legislation taxes income it does not tax capital other than matters relating to real property. Ed ITA is the charging provision which provides for income tax to be payable for each year of assessment YA upon the income of any personIncome is taxable if it falls within one of the enumerated heads of charge under. Garis Panduan Permohonan Untuk Kelulusan Ketua Pengarah Hasil Dalam Negeri Malaysia Di Bawah Subseksyen 446.

Learn about the deductibility of specific business expenses M-R. If you are a one-time donor you will receive a donation receipt from UNICEF for every donation you make. Corporate Income Tax Rate Rebates.

Of The Income Tax Act 1967. Emigration was problematic as Jews were required to remit up to 90 of their wealth as a tax upon leaving the country. Yes all donations to CRY are 50 exempt from tax under section 80G of the Income Tax Act.

The cap increases to 2 if the company implements any. Clean Ganga Fund established by Govt. The SME company means company incorporated in Malaysia with a paid up capital of.

Will my credit card and bank account information remain confidential. Gifts are not income but capital. UNICEF Malaysia adheres to a strict policy regarding donor.

It was officially founded on 1 May 1954 under the name Holy Spirit Association for the Unification of World Christianity HSA-UWC in Seoul South Korea by Rev. Tax Accounting. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. View Example 1 PDF 56KB for an illustration of how the medical expense capping is applied. Corporations established in the past ten years or less with carryforward losses and that are not a subsidiary of a large corporation is 40 of the corporate tax liability while the rate of 25 is.

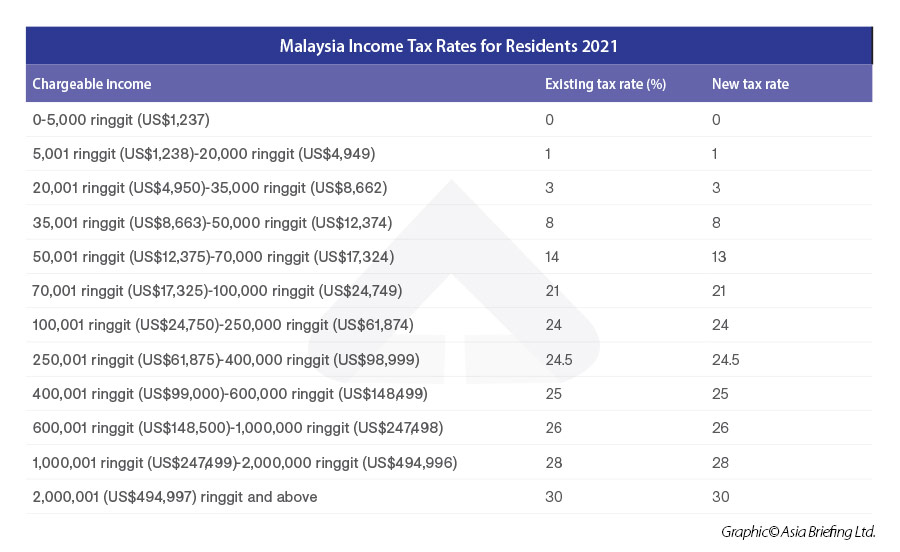

Donations received by such charities are. Americas 1 tax preparation provider. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

You can also contribute using BHIM UPI 100 Income Tax exemption under section 80G DDCheque in favor of Clean Ganga Fund For Electronic Transfer. Headquarters of Inland Revenue Board Of. Of India as a CSR activity.

Vehicle insurance may additionally. 5 of the technical service fees and the Singapore tax. 1 online tax filing solution for self-employed.

ASCII characters only characters found on a standard US keyboard. A DTR will be accorded based on the lower of the foreign tax paid in Malaysia ie. In addition the tax credit limitation for certain RD venture corporations ie.

Food Aid Foundation as a food bank in Malaysia is a non-profit governmental organization NGO incorporated on 2013 that is where manufacturers distributors wholesaler retailers companies or people can donate their unused or unwanted foods which will then be collected and distributed to charitablewelfare homes volunteer welfare organisation refugees community poor. See todays top stories. Guidelines Under Subsection 446 Of The Income Tax Act 1967.

NGO that is a food bank in Malaysia where manufacturers distributors wholesaler retailers. Tax exemption is valid only in India. A trust that is created by a person during his or her lifetime with effect from 9 May 2022This will be known as ABSD Trust.

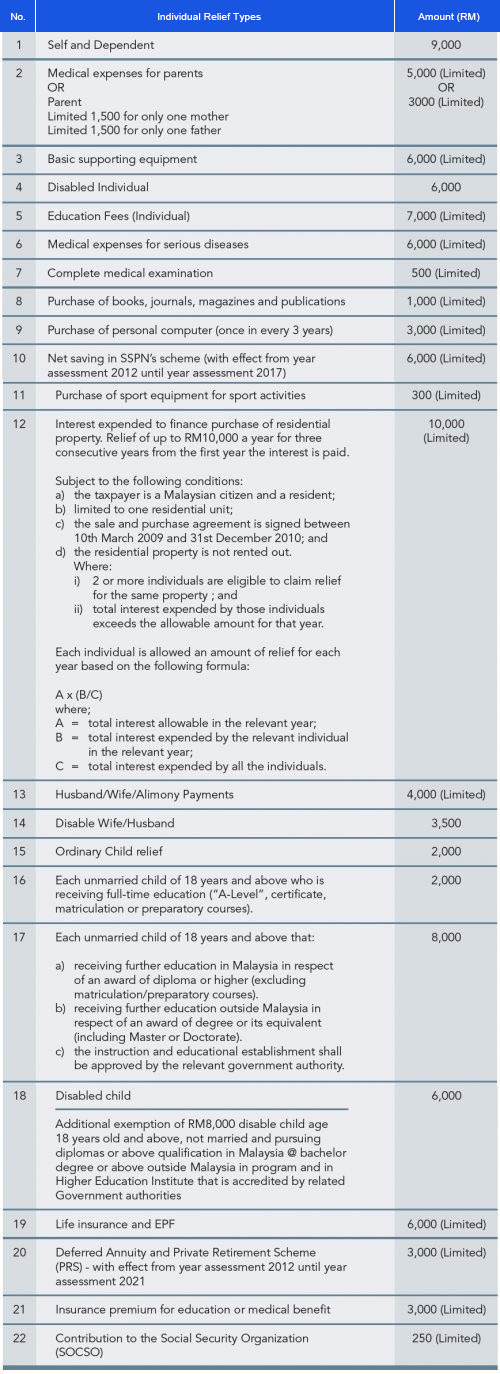

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax. The Family Federation for World Peace and Unification widely known as the Unification Church is a new religious movement whose members are called Unificationists or more widely known as Moonies. 6 to 30 characters long.

How will I get a tax exemption certificate for my donation. Must contain at least 4 different symbols. For every donation of RM50 and above it is also tax exempt under Section 446 of the Income Tax Act 1967.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Get the latest science news and technology news read tech reviews and more at ABC News.

Food Aid Foundation 201301022112 1051942-D All Right Reserved Food Aid Foundation granted exemption of deductions from donations under Subsection 446 of Income Tax Act. We will send across your donation receipt either by email or on your address this receipt is eligible for tax exemption and can be shared with the. Residential properties transferred into trusts for housing developers will continue to be subject to the.

With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. As Jews were no longer permitted to work in the civil service or government-regulated professions such as medicine and education many middle-class business owners and professionals were forced to take menial employment. As per the revised tax exemption act effective April 1 2017 When you make donations above 500 to Akshaya Patra your donation amount will be eligible for 50 tax exemption under Section 80G of Income Tax Act.

Medical expenses incurred for employees are tax-deductible as long as they are capped at 1 of the total employee remuneration accrued for the year. WTOP delivers the latest news traffic and weather information to the Washington DC. On 8 May 2022 the Government announced that ABSD of 35 will apply on any transfer of residential property into a living trust ie.

State Bank of India New Delhi Main Branch IFSC Code. Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop or smartphone. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

The exemption is calculated by reducing the. The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021. Companies may claim foreign tax credit for tax paid in a foreign jurisdiction against the Singapore tax payable on the same income.

Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

Lhdn Irb Personal Income Tax Relief 2020

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Donating Building Materials To Charity Through Deconstruction

Understanding Tax Smeinfo Portal

A Proposed Tax Break For The Masses Designed To Spur Giving

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

How Anyone Can Get A 2021 Tax Deduction Charitable Donations

Bts Malaysia Army On Twitter Tabung Covid 19 Kkm Receipts Bts Twt Https T Co Zwzosixole Twitter

How To Get A Clothing Donation Tax Deduction Toughnickel

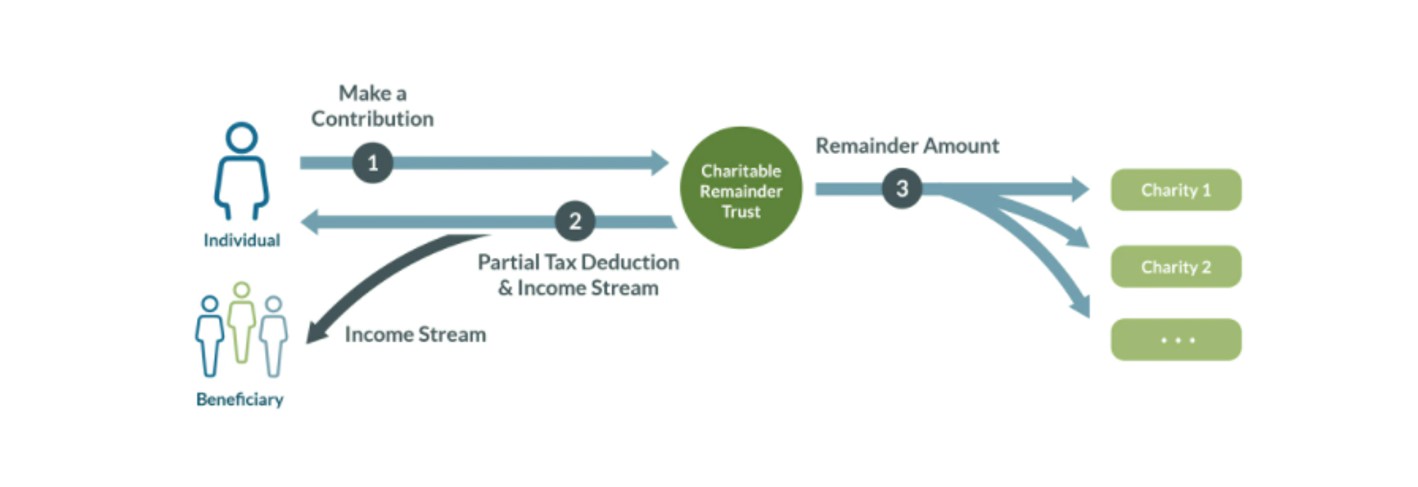

The Charitable Remainder Trust Crt And Crypto Htj Tax

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Income Tax Relief Items For 2020 R Malaysianpf

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

The Complete Income Tax Guide 2022

Updated Guide On Donations And Gifts Tax Deductions

Newsletter 56 2018 Guideline On Income Tax Exemption For Religious Institution Or Organization Under Income Tax Exemption Order 2017 Page 001 Jpg

Comments

Post a Comment